Cryptocurrency mining

According to Alan Feuer of The New York Times, libertarians and anarcho-capitalists were attracted to the philosophical idea behind bitcoin. Early bitcoin supporter Roger Ver said: “At first, almost everyone who got involved did so for philosophical reasons. https://wildtouchlab.com/sculpture-as-an-art-form/ We saw bitcoin as a great idea, as a way to separate money from the state.” Economist Paul Krugman argues that cryptocurrencies like bitcoin are “something of a cult” based in “paranoid fantasies” of government power.

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach” to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.

As the popularity and demand for online currencies has increased since the inception of bitcoin in 2009, so have concerns that such an unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.

Best cryptocurrency

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. While we may highlight certain positives of a financial product or asset class, there is no guarantee that readers will benefit from the product or investment approach and may, in fact, make a loss if they acquire the product or adopt the approach.

To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. As such, any recommendations or statements do not take into account the financial circumstances, investment objectives, tax implications, or any specific requirements of readers.

While you can invest in cryptocurrencies, they differ a great deal from traditional investments, like stocks. When you buy stock, you are buying a share of ownership of a company, which means you’re entitled to do things like vote on the direction of the company. If that company goes bankrupt, you also may receive some compensation once its creditors have been paid from its liquidated assets.

Competing metaverse Decentraland was this year’s number seven performer, after its MANA token soared nearly 40-fold. The entry of institutional players was a large contributor to gains for both SAND and MANA. This past quarter, retail giants such as Adidas and Under Armour announced partnerships with The Sandbox and Decentraland, respectively.

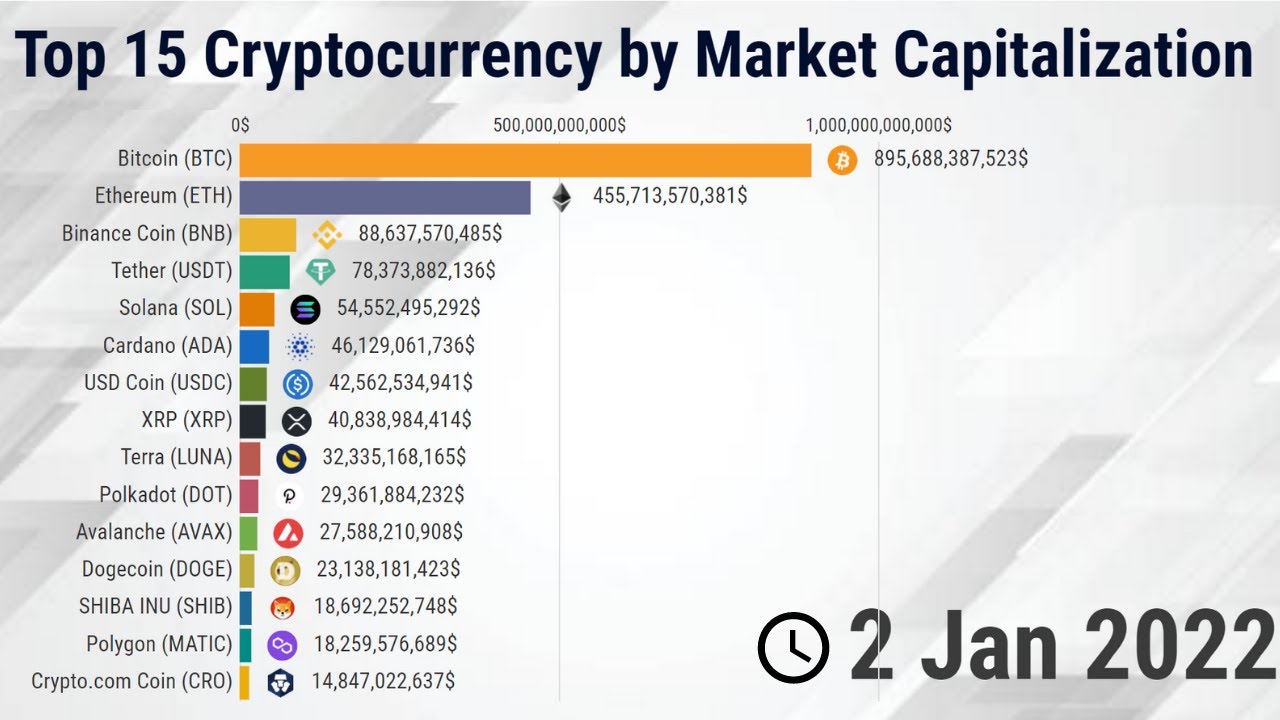

Congestion on the largest smart contract-enabled blockchain sent users in search of more scalable blockchains, spurring the growth of alternative layer 1 blockchains and scaling tools. The year brought astronomical gains for the likes of Avalance, Fantom, Polygon and Terra, which ate up half the slots in the top 10.

Future of cryptocurrency

At KlimaDAO, for example, we are aligning economic incentives for a green regenerative economy, making on-chain carbon retirement accessible to all. KlimaDAO’s native token “KLIMA” can only be minted when tokenized carbon credits are locked away in its treasury. This is achieved by offering incentives to users to exchange tokenized carbon in return for KLIMA at a discounted price. The KLIMA token is itself backed by carbon. As the KlimaDAO treasury acquires more carbon over time through its incentives, any newly minted KLIMA tokens are distributed to those who hold KLIMA themselves.

Research from the University of Cambridge shows that the renewable share of these energy mining pools is as high as 78%. Although there are exceptions depending upon which region of the world you’re focusing on, hydroelectric power, in particular, is rapidly emerging as the de facto power source for crypto-mining operations.

Meanwhile, policymakers who have been sounding an alarm about crypto’s excessive risks, while failing to create sensible regulations, have been vindicated by not one, but multiple large-scale failures.

The Bank of England says its regulation would aim to “harness the potential benefits stablecoins could provide to UK consumers and retailers, in particular by making payments faster and cheaper” while working to protect consumers by preventing money laundering and safeguarding financial stability.

According to the World Economic Forum’s Global Future Council on Cryptocurrencies, there has been no internationally coordinated regulation of cryptocurrencies — though international bodies have been working on assessing risks and appropriate policy responses to the rise of cryptos.

The Governor of Banco Central do Brasil, Roberto Campos Neto, said among the cryptocurrencies being used by Brazilians, local demand had shifted toward stablecoins, with people using cryptocurrencies more as a means of payment rather than just for investment.