Is cryptocurrency dead

Coryanne Hicks is an investing reporter, finance writer and ghostwriter whose work appears in Forbes Advisor, U.S. News & World Report, Kiplinger, Business Insider publications. philippine tours Hicks has ghostwritten white papers and financial guidebooks for dozens of industry professionals. Her U.S. News video series on how to start investing at any age won an honorable mention at the 2019 Folio: Eddie & Ozzie awards for best Consumer How-To video. She was also a 2019 SABEW Goldschmidt fellow for business journalists. Previously, Hicks was a fully-licensed financial professional at Fidelity Investments.

A consortium co-founded by Circle called Centre launched USDC in 2018 as a joint venture between Circle and Coinbase. Like Tether, the USDC is a fully regulated stablecoin in a 1:1 ratio with the U.S. dollar. It offers the speed and security of blockchain technology while maintaining a price for stability.

The world of cryptocurrency is much bigger today, with various coins and tokens with use cases that go well beyond being a medium of exchange. Many of these cryptos are not necessarily Bitcoin competitors.

People who participate in cryptocurrency networks use coins as a primary form of digital money to buy goods and services and to transfer value amongst each other. In addition to coins with fluctuating value, stablecoins in cryptocurrency exist to provide a less risky option.

Algorithmic stablecoins. These stablecoins use algorithms to control their supply and thus maintain their price peg. An example is TerraUSD (UST), which was initially pegged at $1 by creating and destroying a sister coin called Luna. Every time TerraUSD was bought or sold, a respective amount of its sister token, Luna, was created or destroyed.

Cryptocurrency stocks

The Coinbase platform’s success has been contingent on the increase in crypto prices, which, in turn, has led to millions of new users creating accounts. Coinbase earns a small transaction fee whenever someone buys or sells a cryptocurrency. But the company aspires to be more than just a place to trade. It also sponsors a debit card that allows consumers to spend from the balance in their digital wallet, and it’s launched a cloud platform for companies using and storing digital currencies.

However, the sector is subject to sharp market swings. Its peak value of $3 trillion slipped to less than $1 trillion in June 2022 as rising inflation drove many investors away from high-risk investments. This was not the crypto market’s first gigantic plunge, and it probably won’t be the last. Every investment is subject to risks, and you should only invest money you don’t need in the short term. That guidance is even more important in the highly volatile crypto sector.

The Coinbase platform’s success has been contingent on the increase in crypto prices, which, in turn, has led to millions of new users creating accounts. Coinbase earns a small transaction fee whenever someone buys or sells a cryptocurrency. But the company aspires to be more than just a place to trade. It also sponsors a debit card that allows consumers to spend from the balance in their digital wallet, and it’s launched a cloud platform for companies using and storing digital currencies.

However, the sector is subject to sharp market swings. Its peak value of $3 trillion slipped to less than $1 trillion in June 2022 as rising inflation drove many investors away from high-risk investments. This was not the crypto market’s first gigantic plunge, and it probably won’t be the last. Every investment is subject to risks, and you should only invest money you don’t need in the short term. That guidance is even more important in the highly volatile crypto sector.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

TThe data at CoinMarketCap updates every few seconds, which means that it is possible to check in on the value of your investments and assets at any time and from anywhere in the world. We look forward to seeing you regularly!

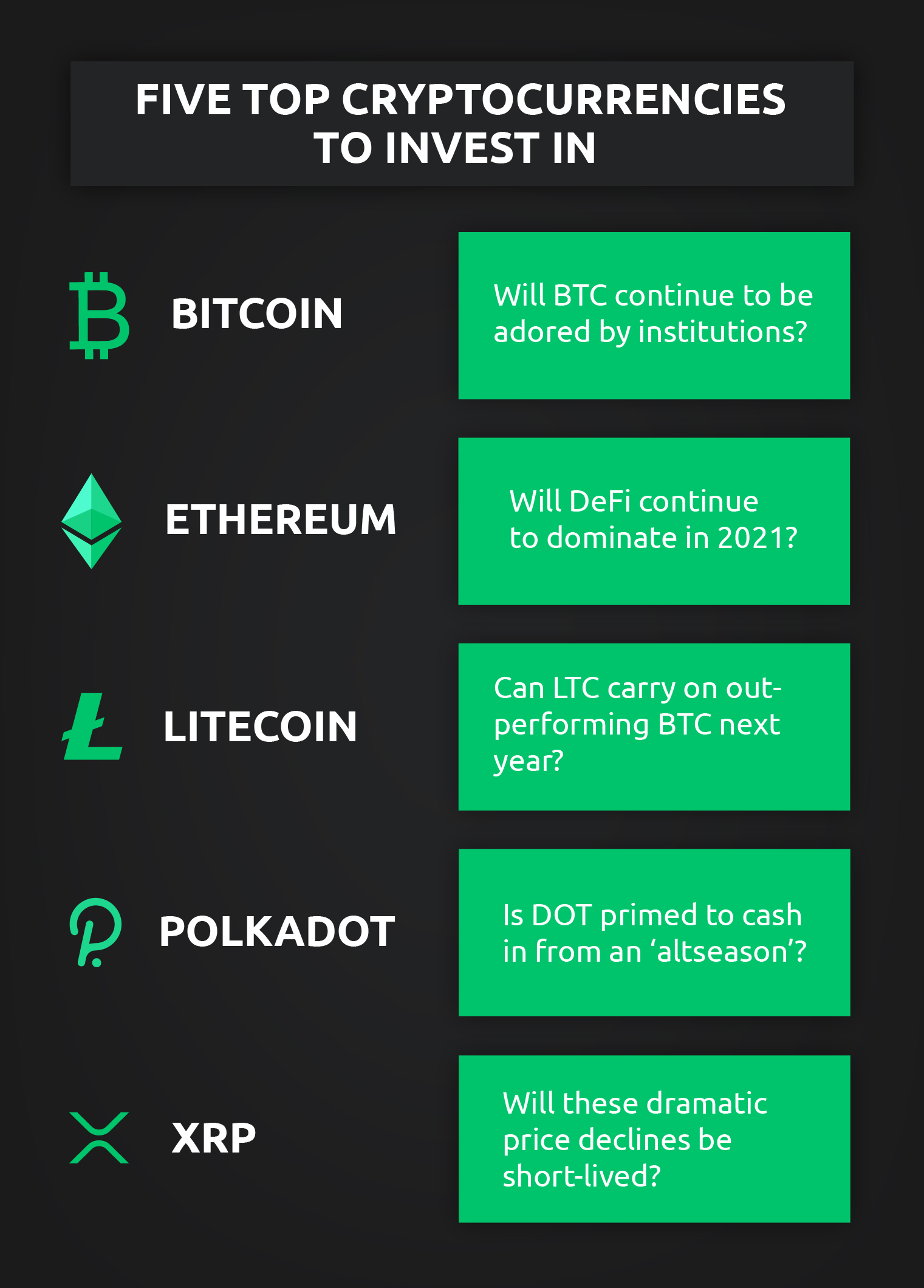

Best cryptocurrency to buy

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Bitcoin (BTC) is the original cryptocurrency created in 2009 by Satoshi Nakamoto. As with most cryptocurrencies, BTC runs on a blockchain, or a ledger logging transactions distributed across a network of thousands of computers. Because additions to the distributed ledgers must be verified by solving a cryptographic puzzle, a process called proof of work, Bitcoin is kept secure from fraudsters.

Crypto investment giant Grayscale has launched a new fund that provides exposure to Aave’s AAVE token, marking another addition to the company’s lineup of cryptocurrency products. Aave has become the largest cryptocurrency lending protocol by total value locked (TVL), according to DeFiLlama. At the time of writing, Aave has a TVL of $12.6 billion.

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Bitcoin (BTC) is the original cryptocurrency created in 2009 by Satoshi Nakamoto. As with most cryptocurrencies, BTC runs on a blockchain, or a ledger logging transactions distributed across a network of thousands of computers. Because additions to the distributed ledgers must be verified by solving a cryptographic puzzle, a process called proof of work, Bitcoin is kept secure from fraudsters.

Crypto investment giant Grayscale has launched a new fund that provides exposure to Aave’s AAVE token, marking another addition to the company’s lineup of cryptocurrency products. Aave has become the largest cryptocurrency lending protocol by total value locked (TVL), according to DeFiLlama. At the time of writing, Aave has a TVL of $12.6 billion.